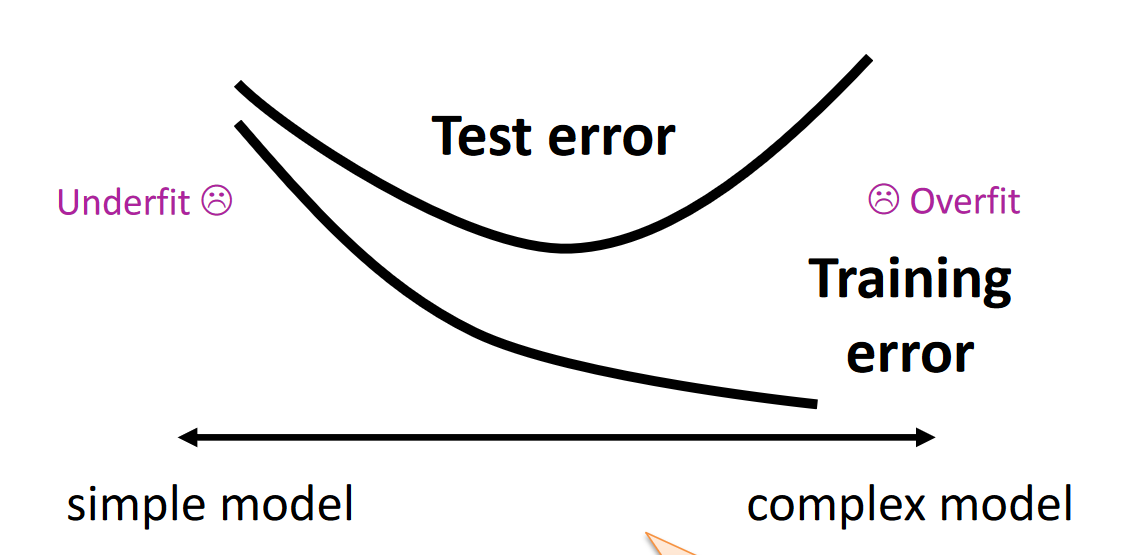

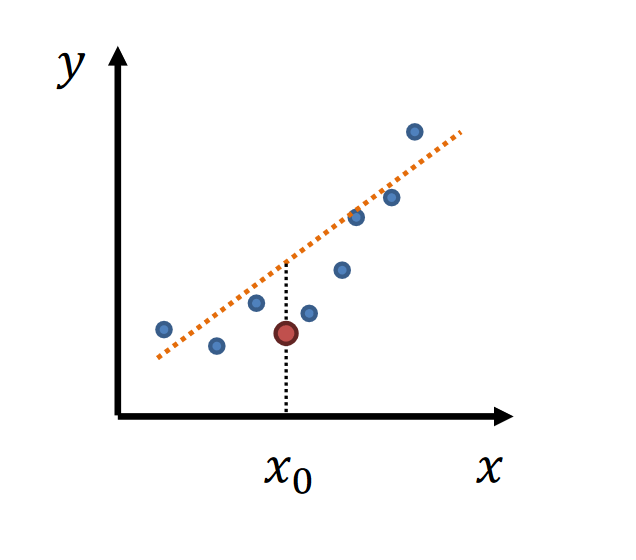

2. Bias-variance trade-off

Bias-variance trade-off

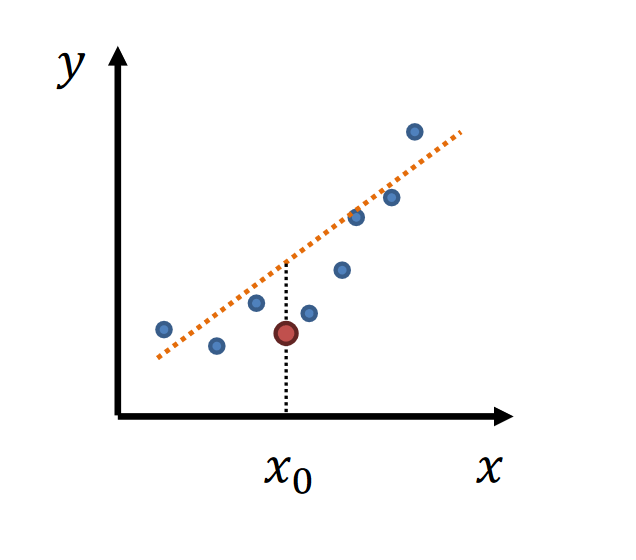

- simple model → low variance, high bias

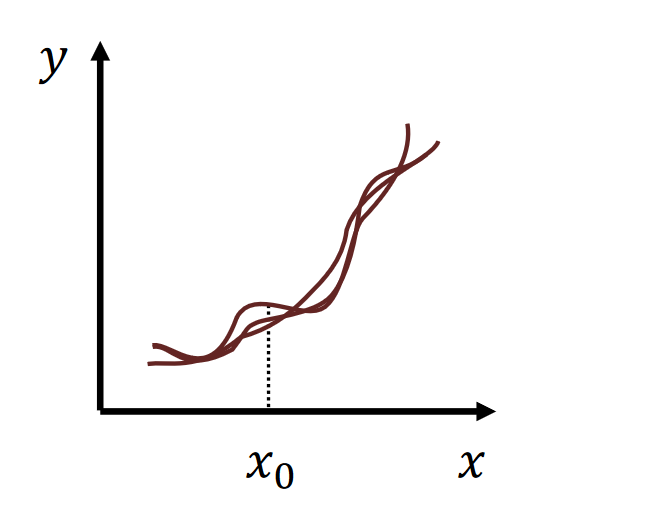

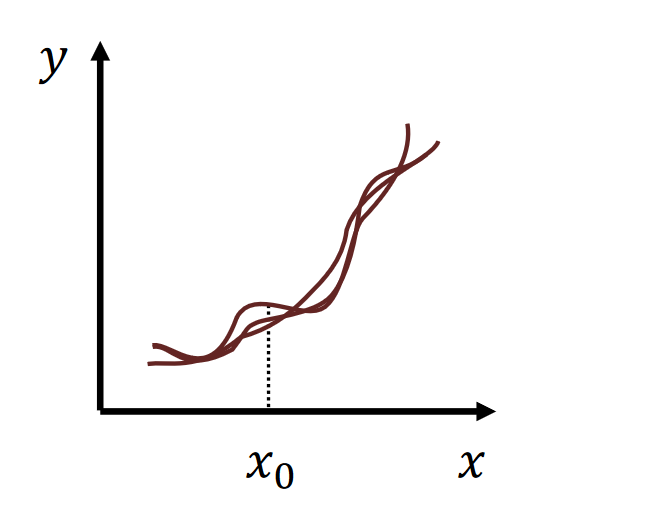

- complex model → high variance, low bias

|  |

|---|

| high variance | high bias |

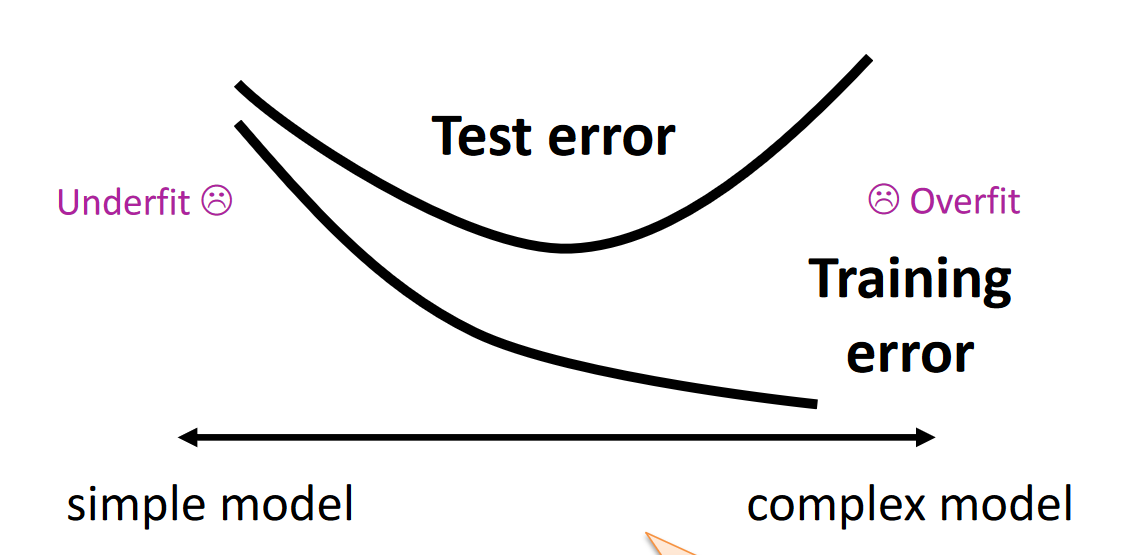

Testing and trainning error

Empirical Risk and True Risk

The true risk is the expected value of the loss 𝑙

R[f]=E[l(Y,f(X))]=∫l(Y,f(X))P(X,Y)dXdY

- l(Y,f(X)): Loss function

- P(X,y) joint distribution of input X and target Y

The empirical risk is an estimate (an average of a finite number of samples 𝑛) of the expected value

- sample size →∞, the true risk is the empirical risk

Structural Risk Minimisation

R^D[f^D]+2nlog∣F∣+log(1/δ)

VC dimension

F shatters {x1,x2} : Possible Labelings

- (0, 0)

- (0, 1)

- (1, 0)

- (1, 1)

If 1 of the 4 labels missing, F does not shatter {x1,x2}

The number of maximun shattering sets = VC(F)

if F shatters {x1,x2,x3} and unique rows: 23=8, VC(F)=3

Sauer-Shelah Lemma

The Upper bound of growth function SF(n) given finite VC(F):

SF(n)≤i=0∑VC(F)(in)

Since ∑i=0k(in)≤(n+1)k, the above implies:

logSF(n)≤VC(F)log(n+1)

Structural Risk Minimisation(VC)(VC Generalisation Theorem)

R^D[f^D]+8nVC(F)log(2n+1)+log(4/δ)